Fortify’s Early Default Detection feature is designed to protect your law firm from taking on high-risk payment plans. Our system uses a simple litmus test to identify potential defaults early.

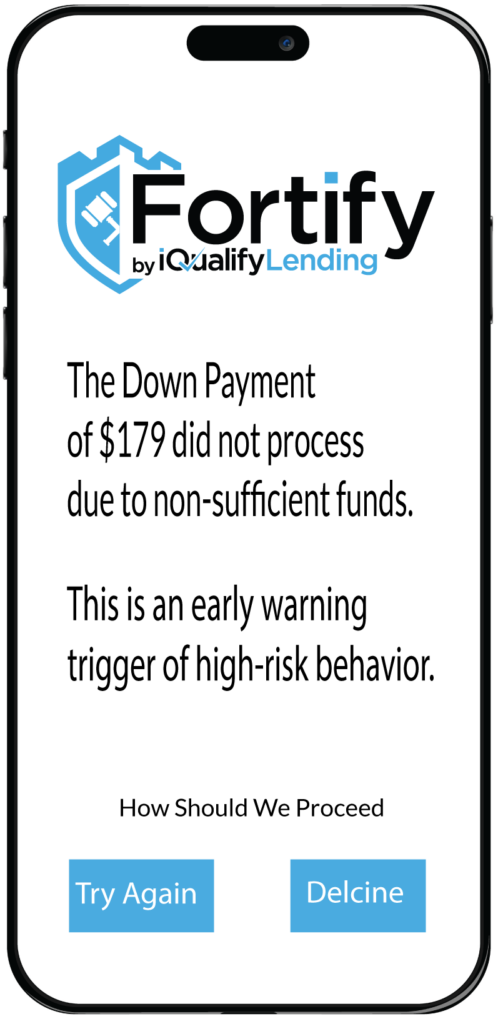

The first step is to check if the client can make the initial down payment of $179. If the client fails to make this payment, it is a significant indication that they may default on future payments as well. Our system flag these files as high-risk for default, giving you the opportunity to make quick decisions and de-risk your payment plans effectively.

The feature works by marking files as high-risk for default if a client cannot make the initial down payment of $179.

You still have the power to override the recommendation, but with your feedback, we balance reasonability and risk to ensure the best outcome for your firm. Additionally, our client success team can keep clients on track and reach out to them if they miss a payment.